QuickBooks Ledger, the Next Simple, Great Thing

Insightful Accountant

NOVEMBER 21, 2023

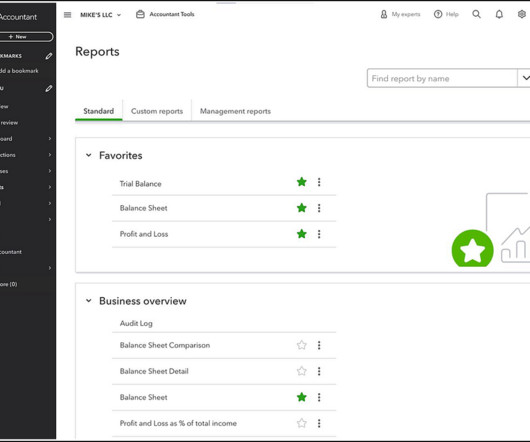

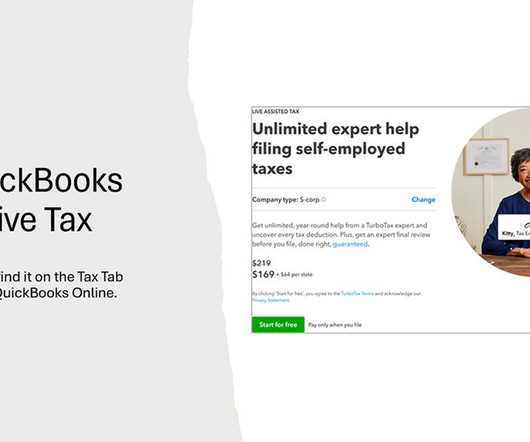

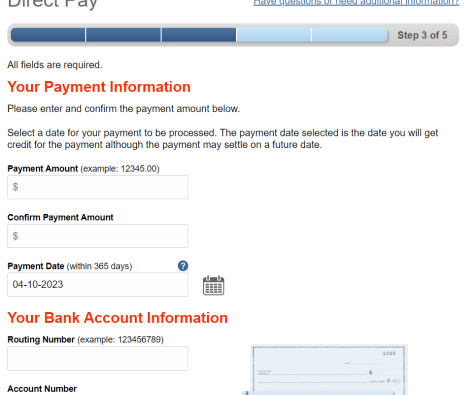

Intuit has found a new way to incorporate more client data into the QuickBooks ecosystem even when the client doesn't subscribe to it. QuickBooks Ledger. It's a way to 'ledger' client data, validate it, and pass it on for tax preparation.

Let's personalize your content